Five large-cap companies that we categorized as “high-risk” struggled throughout the year.

Here at Watchdog Research, we provide independent reports on publicly traded companies. Each company has two reports, a Watchdog Report, and a Gray Swan Event Factor Report.

Our Watchdog Reports use red, yellow, and green flags to make it easy to spot potential governance, accounting, legal, and oversight issues. Our Gray Swan Event Factor (GSEF) estimates what kind of negative impact a company’s past will have on their future.

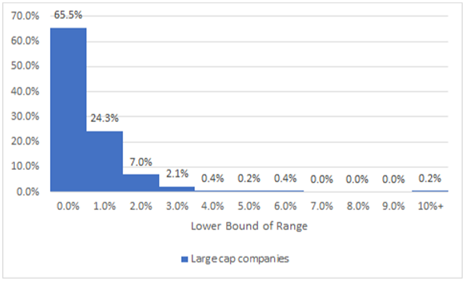

Most companies have a relatively low GSEF score, in January 2020, only 5 large cap companies had scores over 5% (our threshold for considering a company “high-risk”). Here is a histogram of the GSEF scores for large cap companies. As you can see, even scoring above 2% is unusual.

We thought it would be fun to revisit the high-risk companies after such an interesting year and see how they performed in 2020. When we look at each company, we will look at their GSEF on January 1, 2020, returns in 2020, any major red flags, and offer a brief analysis.

In the aggregate, the few companies that we categorized as high-risk performed abysmally in comparison to the S&P 500, which gained 16.26% in 2020.

1. Kraft Heinz (KHC)

11.15% GSEF: Extreme Risk

Return in 2020: 9.65%

Major Red Flags:

In 2019 Kraft Heinz issued a restatement impairing $15.9 billion in goodwill and intangible assets and disclosing serious internal control issues. In response, share prices fell by approximately 25%. The chaos from this restatement continued into 2020 as KHC was subject to multiple lawsuits, including a derivative suit.

Analysis:

Kraft Heinz has slowly been recovering from its catastrophic fall in 2019. KHC stated in its second quarterly report that they have addressed the material weaknesses in their internal controls. However, KHC also impaired an additional $3.4 billion in goodwill and intangible assets in the first nine months of 2020.

Kraft Heinz has survived 2020. Their survival may be due in part to the coronavirus. It was a good year to sell comfort food in grocery stores. Buying the familiar brands under the Kraft Heinz umbrella probably gave people a much-needed sense of normalcy in an otherwise abnormal year.

It is possible that 2020 could have been a tremendous year for Kraft Heinz, but their past accounting issues and ongoing impairments may have kept them from properly rebounding.

2. Bristol Myers Squibb (BMY)

6.81% GSEF: High Risk

Return in 2020: -2.07%

Major Red Flags:

The BMY merger with Celgene closed in 2019. When two companies of comparable size merge, the surviving company will typically underproduce in comparison to their peers for about two years. This is because the surviving company must attempt to integrate two completely different companies, each with their own set of problems and peculiarities. The “synergies” often are mere puffery that never materialize.

Accounting issues that arise out of a merger usually do not surface for at least a year. This is partly because accounting rules will allow companies to delay internal control assessments for the first year. So, it may take until 2022 to get a clear picture of the any challenges posed by BMY’s merger with Celgene.

We would also note that BMY has not had a comment letter with the SEC since late 2018. A company of that size is typically reviewed every year and the letters are not released until some weeks after the conversation ends, so it is possible that they are working on some complicated issues. A lack of comment letters can also be due to an undisclosed SEC investigation.

Analysis:

BMY is suffering from the typical malaise that strikes companies post-merger. Since they do not produce vaccines and did not quickly develop a therapeutic for the coronavirus (currently they have a therapeutic in phase I of testing), they missed out on the government contracts and hype that so many other companies in the medical field benefitted from this year.

3. Baxter International Inc (BAX)

5.24% GSEF: High Risk

Return in 2020: -6.56%

Major Red Flags:

In 2020, BAX had to delay its 10-k for 2019 because of internal control issues and a pending restatement. That restatement was issued shortly thereafter and restated figures from 2017, 2018, and 2019. It has led to several serious and ongoing problems, including a costly securities class action suit.

The last comment letter from the SEC was in 2017, even though it is likely that BAX is reviewed every year because of its size. In 2018, BAX’s numbers did not conform to Benford’s law. The presence of Benford’s law anomalies and the absence of comment letters both can be associated with an undisclosed SEC investigation.

After disclosing the restatement, BAX warned that they may be subject to SEC enforcement. They did not say if their disclosure was due to an ongoing investigation.

Analysis:

Baxter is the only company on this short list whose GSEF was higher at the end of 2020 than at the beginning. They have had a challenging year. It is typical for companies that issue a restatement to suffer stock declines has investor confidence plummets.

BAX produces medical devices, which is a growing field, but many of their customers (hospitals and similar businesses) experienced slow-downs this year as people shied away from receiving non-emergency care during the pandemic.

4. Lumen Technologies (LUMN) (formerly CenturyLink)

5.74% GSEF: High Risk

Return in 2020: -17.36%

Major Red Flags:

Lumen Technologies did not file their 10-k on time in 2019 due to a restatement. They also revealed internal control issues that were not fully resolved until the following year. As usually happens, the restatement resulted in a securities class action suit that is still ongoing.

Analysis:

Lumen’s stock dropped during March, like every other company, but unlike many other companies, it did not recover. This is mysterious considering that the coronavirus did not appear to have a material impact on operations. Their poor returns this year may have to do more with a lack of confidence in their attempt to revamp their business.

5. TechnipFMC Plc. (FTI)

6.02% GSEF: High Risk

Return in 2020: -55.93%

Major Red Flags:

FTI issued a restatement in 2017 and had material weaknesses in 2017, 2018, and 2019. FTI also has made 11 changes to accounting estimates in the last three years. In 2020, changes in accounting estimates had a positive impact of over $340 million. However, in 2019, the company also issued an impairment of $1.79 billion. FTI’s CFO departed in January 2021.

Their independent auditor’s critical audit matters disclosures highlighted risks in revenue recognition concerning long term contracts. FTI’s auditors warn that the estimates involved in these estimates require a lot of judgement and are subjective. Uncertainty concerning revenue recognition is always a red flag.

Analysis:

FTI was removed from the S&P 500. This is partly because of a spinoff, but primarily because they were one of the worst performers in the S&P 500 during 2020. FTI’s industry, oil and gas, was hit particularly hard by a loss of demand due to the coronavirus.

Conclusion

Stock prices reflect the confidence and enthusiasm of the market. Accounting, governance, regulatory and legal issues rarely have a significant impact on stock price, unless problems in those areas manifest themselves in a way that dashes the market’s confidence in a company. Our GSEF metric can serve as a proxy for evaluating potential challenges a company will have in keeping (or regaining) the confidence of the market.